In my decades working with CFOs, I have heard the same complaint repeatedly: “IT is a financial black hole.” Money goes in, but nobody can articulate the ROI that comes out. This frustration is valid. The solution is not to cut costs indiscriminately; it is to transform your information technology budget from a bill you pay into an investment portfolio you manage. By distinguishing between “Run the Business” and “Grow the Business” spend, and applying zero-based discipline, you can find the “free money” hidden in your ledger to fund innovation.

Key Takeaways

- An Information Technology Budget is not a bill to pay—it’s an investment portfolio requiring the same rigor you apply to capital allocation, explicitly split between “Run the Business” and “Grow the Business” spending with expected ROI and EBITDA impact for each major line item.

- The shift from CAPEX (buying hardware) to OPEX (renting Cloud/SaaS) creates flexibility but introduces the “Cloud Trap”—uncontrolled recurring costs that can spiral 50% or more without governance and FinOps discipline.

- Zero-based budgeting forces every expense to justify itself from scratch each year, eliminating the “last year’s budget plus 10%” mentality that bakes in waste and misalignment.

- Your IT Steering Committee—comprising the CFO, CIO, and key business leaders—must approve trade-offs across your portfolio, ensuring every dollar connects to business strategy and measurable outcomes.

- A seasoned Fractional CIO often pays for themselves within the first quarter by uncovering zombie software, duplicate vendors, and misaligned projects—freeing “found money” that can fund innovation rather than waste.

Introduction: From Black-Hole IT Spend to a Governed Investment Portfolio

I’ve sat across the table from dozens of chief financial officer leaders who describe their Information Technology Budget the same way: a black hole. Money goes in, and they have no clear line of sight into what comes out. This frustration is understandable—but it’s also fixable. The solution isn’t more spreadsheets or tighter controls. It’s establishing a robust Information Technology Governance Framework that transforms IT spending from an opaque cost center into a transparent, defensible investment portfolio the board can trust.

Most mid-market and enterprise organizations now spend 3–8% of revenue on technology, with higher ratios in banking, software, and healthcare. Yet when I ask executive teams to articulate the ROI or EBITDA impact for their top ten IT initiatives, the room typically goes quiet. They can point to the technology costs, but not the business value those costs generate. This disconnect is precisely what governance solves.

The core reframing I bring to every engagement is simple: categorize every IT dollar in your IT strategic plan as either “Run the Business” (keeping operations stable, maintaining regulatory compliance, ensuring the lights stay on) or “Grow the Business” (customer-facing innovation, analytics platforms, automation, AI initiatives). When you manage these buckets explicitly—with targets, thresholds, and accountability—IT stops being a mystery and starts being a portfolio you can optimize.

In this article, I’ll walk you through the governance and portfolio thinking that underpins a strategic it budget, the critical CAPEX vs. OPEX dynamics and how to avoid the Cloud Trap, essential budget categories every CFO should demand visibility into, a step-by-step it budgeting process for building a board-ready budget, dedicated cost optimization strategies that find free money, the role of the IT Steering Committee, and how a Fractional CIO creates measurable financial value. Let’s turn that black hole into a growth engine.

What Is an Information Technology Budget in a Governance Context?

An Information Technology Budget is a 12–36 month financial plan governing all technology spending enterprise-wide—not just what flows through the it department, but every dollar touching technology across the organization. Within a mature Information Technology Governance Framework, this budget becomes a core artifact: a single source of truth that consolidates centralized IT, shadow IT lurking in business units, and externally driven technology obligations like PCI-DSS, HIPAA, SOX, or GDPR compliance.

Unlike a generic departmental budget, an effective it budget must explicitly map to business capabilities. Each major line item—whether it’s your ERP platform, cybersecurity stack, or data analytics infrastructure—needs an owner, a purpose, and a value story. Digital sales, order fulfillment, risk management: these are the capabilities your technology investments enable, and your budget should make those connections visible to every key stakeholder.

Here’s the principle I apply ruthlessly: if an item’s business value, risk impact, or mandatory obligation cannot be articulated and measured, the default stance should be to cut or defer it. This isn’t about starving IT—it’s about discipline. Your it investment decisions should be as defensible as any other capital allocation you present to the board.

Leading organizations now treat their it budget as a rolling financial plan, reviewed at least quarterly, with variance analysis, TCO tracking, and KPI dashboards presented to the executive team. This isn’t annual theater; it’s continuous portfolio management that enables rapid budget adjustments when business priorities shift.

Investment Portfolio Mindset: Run the Business vs. Grow the Business

A modern Information Technology Budget should be structured like an asset allocation model, not a static cost list. When I engage with a new client, one of my first requests is to see how they’ve categorized their it spending. Too often, everything is lumped together—making it impossible to distinguish between keeping the lights on and investing in revenue growth.

I recommend creating two primary budget views for every fiscal year:

| Category | Definition | Typical % of IT Budget | Key Metrics |

|---|---|---|---|

| Run the Business (RTB) | Core infrastructure, service desk, ERP/HRIS, mandatory security, compliance tooling, essential vendor support | 60–80% | Uptime, incident rates, compliance scores |

| Grow the Business (GTB) | Customer experience, e-commerce, analytics, automation (RPA), AI pilots, strategic modernization | 20–40% | ROI, payback period, EBITDA uplift |

RTB spend is where risk and continuity dominate the business case. These are technology resources you cannot operate without—but they’re also where waste accumulates. GTB spend is where growth happens, but each initiative must have quantified ROI, a realistic payback period, and explicit EBITDA impact estimates. No hand-waving allowed.

Consider a $20M-revenue firm with a $1.2M IT budget currently allocating 70% to RTB and 30% to GTB. By systematically reducing RTB costs through consolidation and automation—shifting to a 60/40 ratio—they can redirect $120,000 annually toward strategic initiatives that directly support business growth. That’s not marginal; that’s a material shift in technology investments.

The IT Steering Committee must agree on target RTB/GTB ratios annually and actively move dollars from low-ROI RTB activities (like maintaining legacy systems past their useful life) into GTB initiatives with higher returns. This is where real portfolio management happens.

And portfolio management includes pruning. A disciplined Fractional CIO brings “kill lists” as well as “wish lists” to budget reviews. Sunsetting systems and projects that no longer meet hurdle rates isn’t failure—it’s fiduciary responsibility.

CAPEX vs. OPEX and the Cloud Trap

The traditional IT model—buying servers, building data centers, purchasing perpetual software licenses—meant heavy upfront capital expenses booked to the balance sheet and depreciated over 3–7 years. This model offered predictability but limited flexibility. You bought capacity for peak demand and watched it sit idle the rest of the year.

The modern model flips this entirely. Cloud services, SaaS subscriptions, and managed service providers transform what was capital expenditures into operating expenses. Your it infrastructure becomes a variable cost that scales with demand. On paper, this sounds like pure upside—lower barriers to entry, faster deployment, reduced data centers footprint.

Here’s the trap I see constantly: the Cloud Trap.

While cloud and SaaS reduce upfront CAPEX, they can drive uncontrolled OPEX growth through:

- Unchecked user counts and seat licenses that accumulate zombie accounts

- Over-provisioned cloud instances running 24/7 when workloads need only 8 hours

- Feature creep as business units add cloud subscriptions without governance

- Multiple overlapping tools (three project management platforms, two video conferencing solutions)

I’ve seen organizations where cloud spending grew 50% year-over-year not because of business growth, but because nobody was monitoring spending or enforcing governance. The convenience of operational expenditures became a runaway cost.

Practical governance tactics to avoid the Cloud Trap:

- Implement FinOps practices: Treat cloud costs like any other P&L line with owners, budgets, and variance reviews

- Rightsize instances quarterly: Analyze actual spending against provisioned capacity

- Enforce approval workflows: Require business cases for any new SaaS over $1,000/month

- Consolidate tools: Eliminate duplicate vendors solving the same problem

- Use reserved capacity: Commit to 1–3 year terms for predictable workloads to reduce unit costs

The IT Steering Committee must approve major CAPEX vs. OPEX trade-offs. When you’re replacing an on-prem data warehouse with a cloud analytics platform, present 3–5 year TCO scenarios, ROI projections, and risk analysis. Make the trade-off visible and defensible.

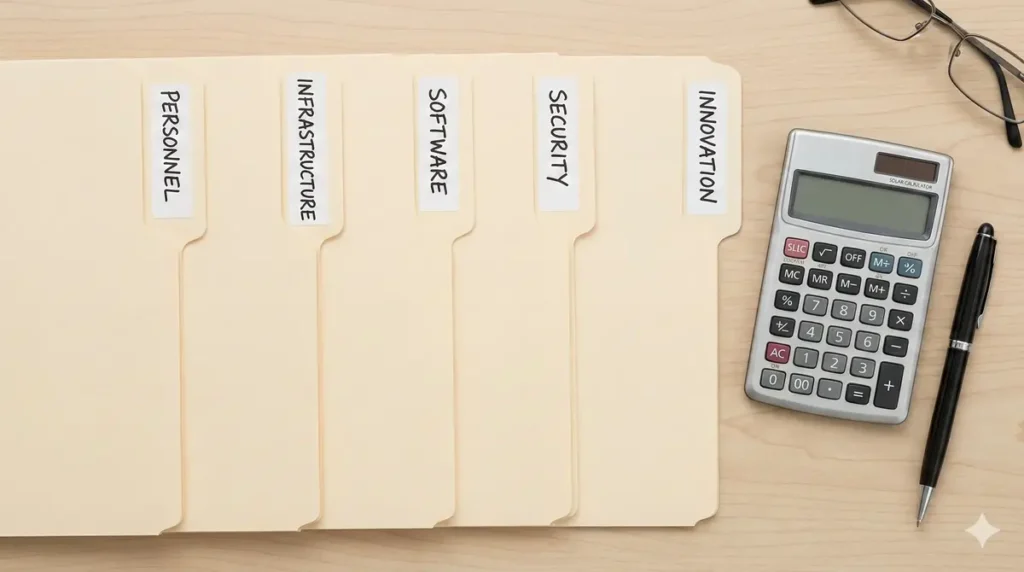

Essential Information Technology Budget Categories

Regardless of industry, a defensible Information Technology Budget should break down into clearly defined categories that finance can reconcile and benchmark. Here’s the framework I use with every engagement:

Personnel

Personnel costs typically represent 40–50% of total IT spend—the largest category by far. This includes:

- Internal salaries, benefits, and pensions for analysts, developers, architects, and leadership

- Contractors and consultants for specialized projects

- Managed services retainers

- Training and certifications to address skill gaps

Calculate your fully loaded cost per FTE (salary + benefits + equipment + training) and your cost per supported user. These ratios allow benchmarking against industry standards and identify whether you’re overstaffed, understaffed, or simply misallocated.

Infrastructure

This category covers your physical and virtual foundation:

- On-prem hardware (servers, storage, networking equipment)

- Data center or colocation costs

- Network connectivity and telecom

- End-user devices (laptops, monitors, mobile)

- Backup and disaster recovery infrastructure

Maintain lifecycle plans with 3–5 year refresh cycles and clear depreciation schedules. An aging infrastructure creates hidden technical debt that eventually explodes into emergency capital expenses.

Software & SaaS

Software now accounts for 20–25% of typical IT budgets:

- Core enterprise applications (ERP, CRM, HRIS)

- Productivity suites (Microsoft 365, Google Workspace)

- Line-of-business systems specific to your industry

- Integration platforms and middleware

- Software licenses and software subscriptions

Track license counts against active usage. I guarantee you have unused software licenses you’re still paying for—this is where zombie software lives and where support contracts often auto-renew without scrutiny.

Security & Compliance

Security spending has grown from 5% to 10–15% of IT budgets over the past decade, and for good reason:

- Identity and access management

- Endpoint protection and antivirus

- SIEM/SOC services (often outsourced)

- Vulnerability management and patching

- Backup and disaster recovery

- Security awareness training

- Compliance reporting tools

Don’t treat security as optional overhead. The average breach costs $4.5M. Prevention is cheaper than recovery.

Innovation & Strategic Initiatives

This is your GTB engine:

- Digital transformation programs

- Data and analytics platforms

- AI/ML pilots (increasingly 10–15% of budgets by 2026)

- Modernization projects

- Customer experience enhancements

Every initiative here must tie to clear business KPIs: cart conversion rates, days sales outstanding, error reduction, revenue growth targets. If you can’t measure the business impact, you can’t justify the spend.

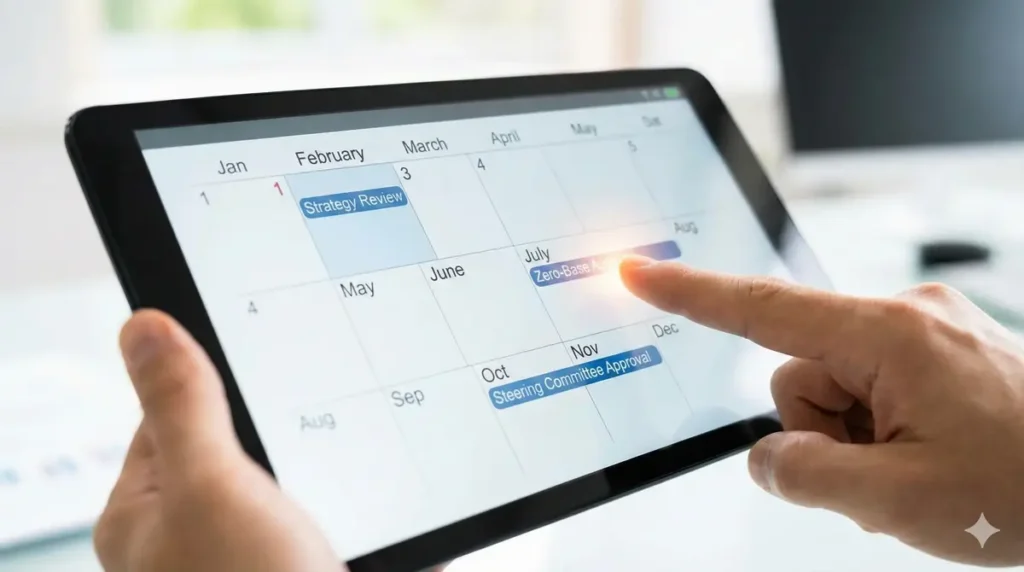

Step-by-Step: How to Build a Strategic Information Technology Budget

This section walks through a practical, board-ready budget development process updated for 2025–2026 realities. The key insight: start budget planning 4–6 months before fiscal year-end, with defined milestones for draft, review, and approval that align with your corporate budget calendar.

Step 1: Re-Anchor on Business Strategy and Risk

Budgeting must begin with a refreshed IT strategic plan—revenue targets, margin goals, and risk appetite for the coming 12–36 months. Do not start with last year’s budget spreadsheet. That’s how you perpetuate misalignment.

Identify 3–5 top strategic priorities. Examples:

- Expand e-commerce in North America (revenue)

- Reduce operational errors by 20% (cost/quality)

- Improve customer retention by 5% (revenue/margin)

- Enter a new market segment (growth)

- Achieve SOC 2 certification (compliance/risk)

Map existing and proposed IT initiatives to each priority. Factor in regulatory changes, M&A plans, and operational shifts like hybrid work. Frame every IT initiative in terms of business objectives and risk reduction—not technical milestones—so they’re understandable at board level.

Step 2: Consolidate Current Spend and Shadow IT

Assemble a 360-degree view of your current it environment and all technology spending across the organization. This means going beyond the it department to capture invoices from marketing, operations, HR, and other units that bypass IT governance.

Practical tactics:

- Review AP ledgers for IT-like GL codes

- Scan for vendor names (Salesforce, Adobe, AWS, Zoom, HubSpot)

- Survey department heads to uncover team-owned SaaS tools

- Analyze spending patterns across credit card statements

Categorize all line items into RTB/GTB and CAPEX/OPEX, then into your essential budget categories. This baseline clarity often reveals immediate cost savings opportunities—and risks from ungoverned shadow IT.

Step 3: Apply Zero-Based Budgeting Discipline

Zero-based budgeting requires every material IT expense (I typically use a $10,000 annual threshold) to justify itself from scratch, regardless of the previous year’s budget. Explicitly reject the “Last Year + 10%” approach—that method bakes in waste, zombie software, and legacy vendors whose it services no longer align with strategy.

Build a template where each line item records:

| Field | Purpose |

|---|---|

| Purpose | Why does this exist? |

| Business Owner | Who is accountable? |

| RTB vs. GTB | Classification |

| Expected Benefit | Quantified value or risk reduction |

| Alternatives Considered | Did we evaluate options? |

| KPI Linkage | How do we measure success? |

| Sunset/Review Date | When do we reconsider? |

This discipline shifts discussions from “Why are you cutting my tool?” to “What measurable value does this deliver relative to alternatives?”

Step 4: Forecast Projects and Initiatives with TCO and ROI

Develop 3–5 year TCO models for major initiatives. Include:

- Implementation costs (software, hardware, consulting)

- Ongoing licenses and cloud usage

- Support and management costs

- Training and change management

- Decommissioning of legacy systems

Each project budget should include estimated ROI, payback period, and EBITDA impact—using both conservative and aggressive scenarios.

Example: Automating manual invoice processing might require $150,000 in implementation but yield $75,000 annual savings in FTE hours, reduce errors by 40%, and improve cash flow through faster cycle times. Document these projections explicitly.

Distinguish between mandatory projects (end-of-life replacements, regulatory upgrades) and discretionary growth initiatives. Label them clearly so prioritize projects decisions are informed.

Step 5: Prioritize and Shape the Portfolio via the IT Steering Committee

The IT Steering Committee evaluates, ranks, and approves trade-offs across IT investments. Present initiatives using standardized one-page summaries:

- Problem: What business challenge are we solving?

- Solution: Proposed approach

- Cost: CAPEX, OPEX, and total TCO

- Classification: RTB or GTB

- ROI: Expected return and payback period

- Risk Impact: What happens if we don’t do this?

- Dependencies: What else must happen?

Examples of portfolio decisions:

- Defer a low-ROI feature upgrade to fund cybersecurity posture improvements

- Consolidate three marketing platforms to free budget for analytics

- Sunset a legacy system to fund cloud migration

Pre-approve criteria for mid-year changes so reallocation decisions can happen quickly without derailing governance.

Step 6: Convert the Portfolio into a Time-Phased Budget

Translate priorities into a month-by-month or quarter-by-quarter budget that finance can integrate with cash flow and P&L forecasts. Phase large projects (multi-phase ERP or CRM programs) across fiscal periods to smooth CAPEX spikes.

Address seasonality:

- Avoid major cutovers during peak retail periods

- Plan migrations during lower-risk windows

- Align with fiscal year-end freezes

The output: a detailed schedule by category showing when fixed costs and recurring costs will hit, and when benefits are expected to start. This enables finance to create an effective it budget forecast with confidence.

Step 7: Establish Monitoring, KPIs, and Reporting Cadence

Define core IT financial KPIs:

| KPI | Frequency | Owner |

|---|---|---|

| IT spend as % of revenue | Quarterly | CFO/CIO |

| RTB vs. GTB ratio | Quarterly | CIO |

| Cost per user | Quarterly | IT Operations |

| Cost per ticket | Monthly | Service Desk |

| Cloud spend variance vs. budget | Monthly | FinOps Lead |

| Project budget variance | Monthly | PMO |

Set up regular reviews: monthly for the it team, quarterly with executive leadership. Compare actual spending against budget and TCO assumptions. Integrate IT metrics with business KPIs (uptime vs. lost sales, incident rates vs. productivity) so non-technical leaders can interpret budget performance.

Define triggers for corrective action—for example, cloud costs exceeding budget by 10% for two consecutive months automatically triggers a FinOps review and report to the Steering Committee.

Cost Optimization: Finding Free Money in Your Information Technology Budget

Cost optimization is not about indiscriminate cuts. It’s about surgically removing waste so you can reinvest in higher-ROI initiatives. This is where a Fractional CIO often proves their value within weeks.

Zombie Software: The Silent Budget Killer

Zombie software consists of licenses or services you’re paying for but not meaningfully using. The benchmark I use: less than 20% active usage over 90 days means it’s a zombie.

How they accumulate:

- Employees leave; licenses don’t get reclaimed

- Pilot projects end; subscriptions continue

- Departments buy tools and then switch to something else

- Mergers bring redundant platforms nobody decommissions

Industry research suggests enterprises waste $1,500–$5,000 per unused seat annually. Across 300 seats, that’s $450,000–$1.5M in unnecessary spending.

Identification techniques:

- License usage audits through vendor portals

- SSO logs showing login frequency

- Vendor utilization reports (most provide these)

- Department surveys asking “What do you actually use?”

Duplicate Vendors: The Consolidation Opportunity

I routinely find organizations paying for:

- Three project management tools (Asana, Monday, Jira)

- Multiple chat platforms (Slack, Teams, legacy systems)

- Overlapping marketing automation platforms

- Several security scanners doing the same job

Rationalize to 1–2 strategic platforms per category. The management costs of multiple vendors—training, integrations, support contacts—often exceed the tools’ individual prices.

Cloud Cost Optimization Tactics

| Tactic | Typical Savings |

|---|---|

| Rightsize instances to actual usage | 20–40% |

| Eliminate orphaned resources (unused VMs, storage) | 10–15% |

| Move to reserved/savings plans for predictable workloads | 30–60% vs. on-demand |

| Implement scheduled shutdowns for dev/test environments | 40–60% |

| Enable autoscaling for variable workloads | 15–25% |

Contract Renegotiation

Start renegotiation 90–180 days before renewal dates. Leverage:

- Consolidated spend across the organization

- Competitive quotes from alternatives

- Multi-year commitment in exchange for discounts

- Reduced seat counts based on actual usage

Quantify and Reinvest

When you find savings, quantify them explicitly: “We freed $250,000 annually by decommissioning two overlapping marketing platforms and 300 unused SaaS seats.” Then tie that “free money” to specific growth or risk-reduction investments. This creates a virtuous cycle where cost optimization funds innovation.

The Steering Committee and Fractional CIO Advantage

The IT Steering Committee is the governance engine ensuring your technology investments are transparent, prioritized, and accountable. Without this body, IT budgets remain black boxes controlled by technologists rather than business leaders.

Ideal Committee Composition

| Role | Responsibility |

|---|---|

| CFO | Financial oversight, ROI validation |

| CIO/Fractional CIO | Technical feasibility, portfolio management |

| Business Unit Leaders | Demand articulation, outcome ownership |

| Risk/Compliance | Regulatory requirements, risk thresholds |

The Committee’s mandate: approve portfolios, monitor outcomes, and arbitrate trade-offs when business needs conflict with budget constraints.

The Fractional CIO Advantage

A Fractional CIO—not embedded in internal politics—can objectively surface low-value spend, challenge sacred cows, and propose bold consolidations that internal it managers may avoid. We don’t have careers to protect or relationships to preserve. We have portfolios to optimize.

Concrete value a Fractional CIO brings:

- Uncovering shadow IT that finance has never seen

- Building RTB/GTB dashboards that make budget creates visible

- Implementing cloud governance and FinOps discipline

- Creating standardized business cases for all initiatives

- Benchmarking your it organization against industry standards

- Training internal leaders to maintain discipline after engagement ends

The cost of a Fractional CIO engagement is typically offset by early savings from rationalization and cloud optimization. I’ve seen 70% of engagements produce 15% or greater savings in the first quarter alone—savings that continue to compound.

View IT leadership capacity as part of your budget portfolio. A Fractional CIO is an investment that amplifies the return on every other IT dollar you spend.

Conclusion: Turn Your Information Technology Budget into a Strategic Weapon

An Information Technology Budget, anchored in a solid Information Technology Governance Framework, is a board-level instrument for directing capital, managing risk, and driving business growth—not an annual exercise in cost justification. When built correctly, it provides the predictability, control, and value visibility that CFOs, CEOs, and board directors demand.

The principles are clear: adopt a portfolio mindset that explicitly separates RTB from GTB spending; manage the CAPEX-to-OPEX shift with discipline to avoid the Cloud Trap; break spending into essential categories with owners and KPIs; apply zero-based budgeting to challenge every line item; and pursue continuous cost optimization through governance, not austerity. Monitor spending relentlessly, review budget performance quarterly, and reallocate funds from underperforming initiatives to higher-value work.

Stop accepting IT as a black hole. When you apply the discipline of zero-based budgeting and the rigor of an information technology budget that separates “Run” from “Grow,” you gain control. You stop asking “How much does IT cost?” and start asking “What is our return on IT investment?”

Ready to Find the Hidden Value in Your IT Spend?

Frequently Asked Questions: Information Technology Budget & Governance

These FAQs address common board-level questions that arise once leaders begin treating IT as an investment portfolio rather than a cost center.

1. How much should we spend on our Information Technology Budget as a percentage of revenue?

Typical benchmarks range from 3–5% of revenue for many mid-market firms, climbing to 7–10% or more for digital-first companies, banking, and healthcare organizations with heavy regulatory requirements. However, the raw percentage matters less than your mix and ROI. A company spending 3% with clear returns on every dollar outperforms one spending 8% with no visibility into outcomes. Your RTB vs. GTB ratios and project-level ROI metrics are often more informative to the board than headline technology spending figures.

2. How often should the Information Technology Budget be reviewed and adjusted?

I recommend an annual budget planning cycle with formal quarterly reviews, plus ad hoc reviews for major strategic shifts, acquisitions, or significant incidents. Cloud-heavy and SaaS-heavy environments benefit from monthly operational reviews (FinOps-style) to prevent small variances from compounding into large overruns. The goal is to monitor spending continuously while making portfolio decisions at appropriate governance intervals.

3. How do we decide whether a particular IT initiative belongs in “Run the Business” or “Grow the Business”?

Apply simple criteria: RTB keeps existing it services available, secure, and compliant; GTB creates new capabilities, revenue streams, or operational efficiency beyond the current baseline. Some initiatives are hybrid—modernizing a core system both reduces risk and enables new products. For budgeting purposes, choose a primary classification and assign a clear business owner. The classification drives how you evaluate ROI expectations and allocate funds.

4. What is the best way to handle unplanned IT spend, such as urgent security fixes or vendor price increases?

Maintain a contingency reserve of 5–10% of your IT budget specifically for unplanned requirements. Establish a formal process for drawing on it that involves the IT Steering Committee or a delegated authority for faster response. After using contingency funds, re-forecast your portfolio immediately, identify possible offsets by deferring lower-priority initiatives, and update the board on material deviations. This prevents budget tracking from becoming fiction by year-end.

5. When does it make sense to bring in a Fractional CIO instead of hiring a full-time CIO?

Fractional CIOs are particularly valuable for organizations between roughly $20M and $500M in revenue, or those undergoing transformation, where full-time enterprise CIO capacity isn’t yet economical. A Fractional CIO can rapidly establish governance, clean up your Information Technology Budget, train internal leaders, and design the portfolio—all while you evaluate whether and when a permanent CIO hire is justified. We create an it budget that reflects strategic reality, then build the team to execute it.